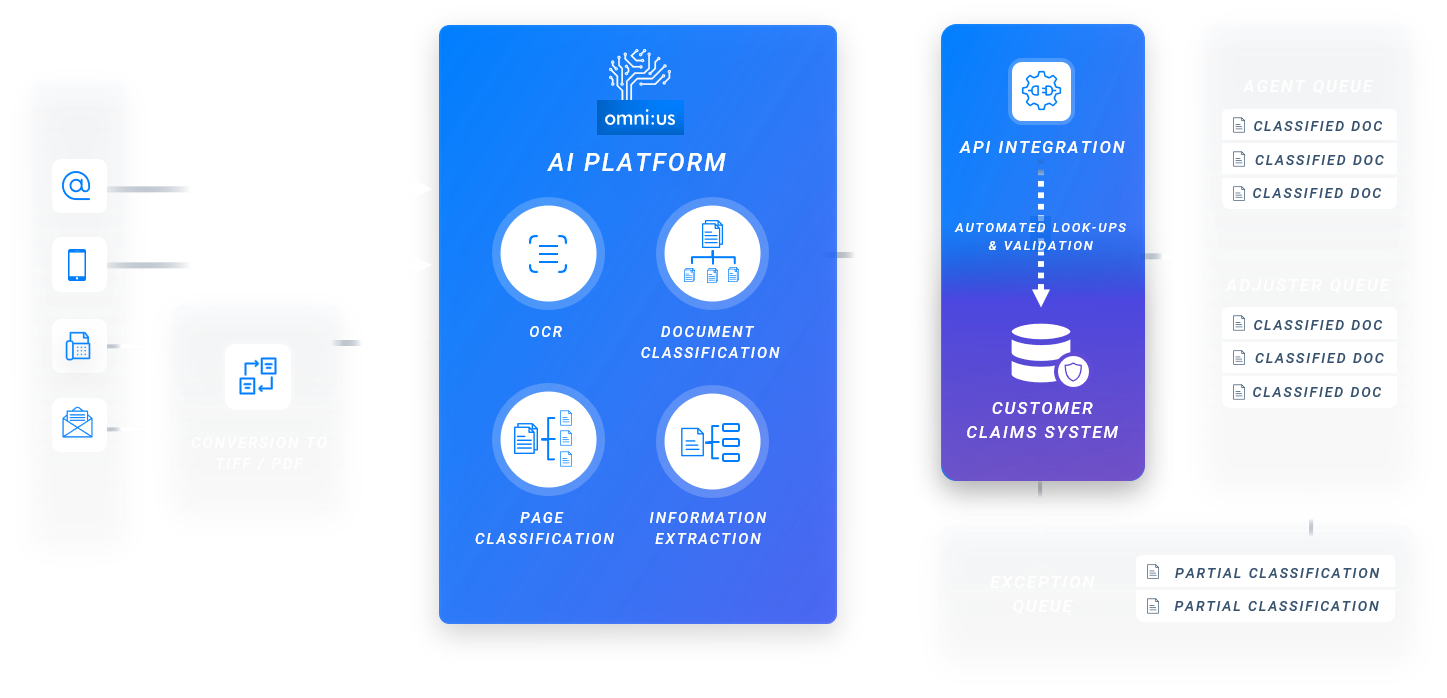

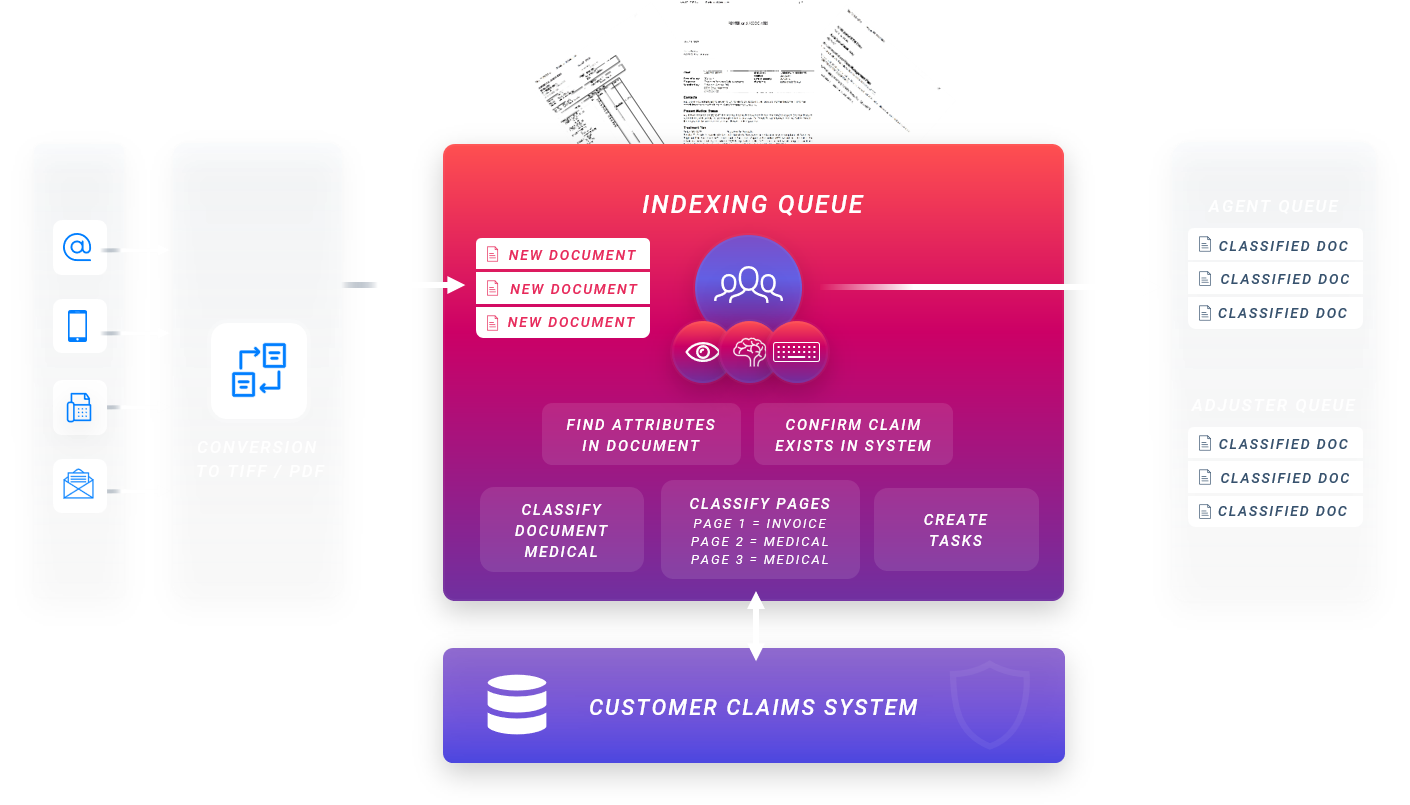

A Fortune 500 insurer wanted to reduce inefficiencies and errors caused by manual document classification and data extraction. omni:us automated the indexation and processing of 100.000 unstructured workers’ compensation claims notification documents provided per day via physical documents, letters, and e-mails.

Classify documents or pages into predefined categories. Based on visual and textual information. Use of state of the art deep learning based classification methods.

Extract information from semistructured documents using state using advanced named entity recognition and end2end information extraction techniques.

Extract information from handwritten forms using language and writer independent handwritten text recognition technology.

Interpret unstructured documents and text with text classification, named entity recognition, language models and question answering techniques.

omni:us is proud to be one of Europe‘s Horizon2020 SME-Instrument and Fet Flag Champions. We are grateful to have received funding from the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement No 820323; 850053.

Co-financed by European Fund for Regional Development (EFRE)

Pro Fit-Project “Vollautomatisierung der Wertschöpfungskette im Digitalisierungsprozess von Archivdaten” with support of IBB/EFRE in 2016/2017.