%

Full Automation

Straight-through-processing

- Focus on simple and medium-complex claims

- End-to-end processing from FNOL to payment

- Significant savings potential due to straight-through-processing

+

+

%

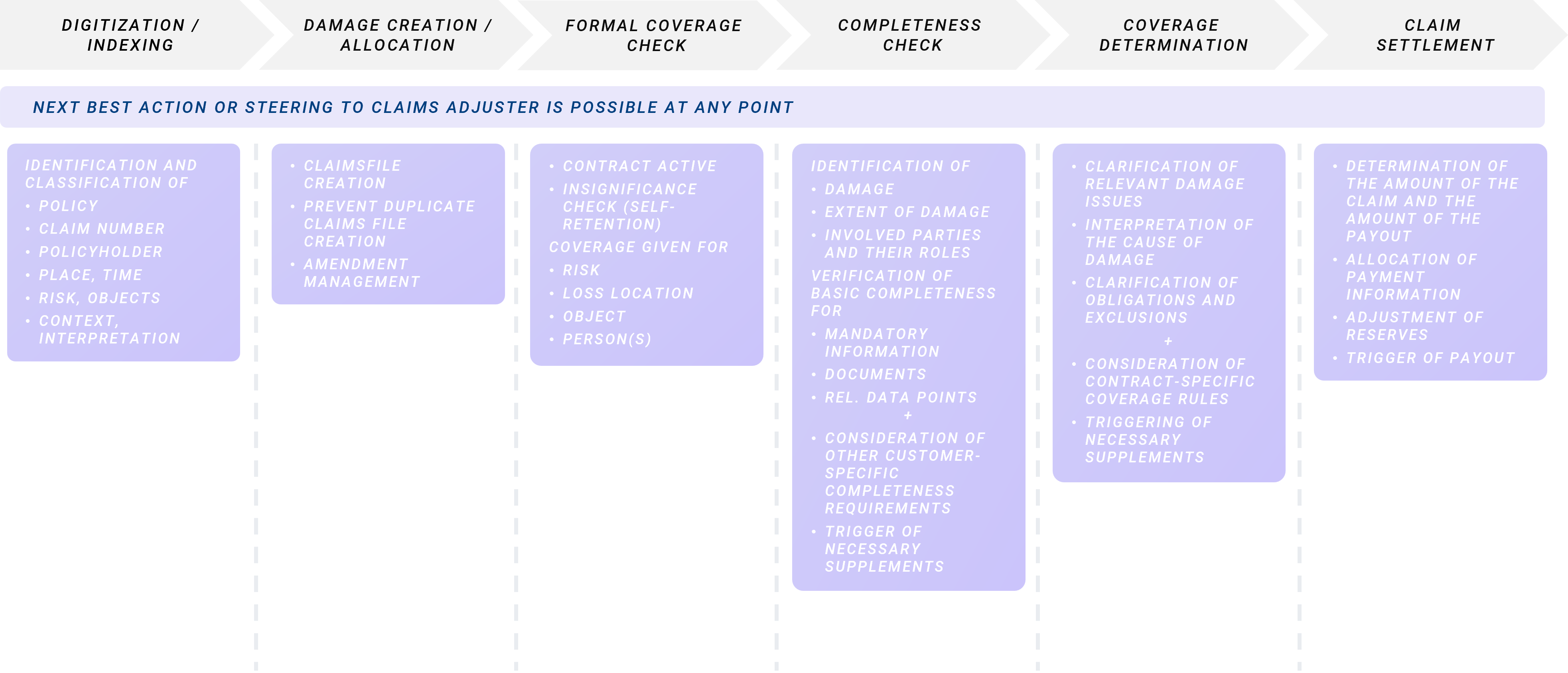

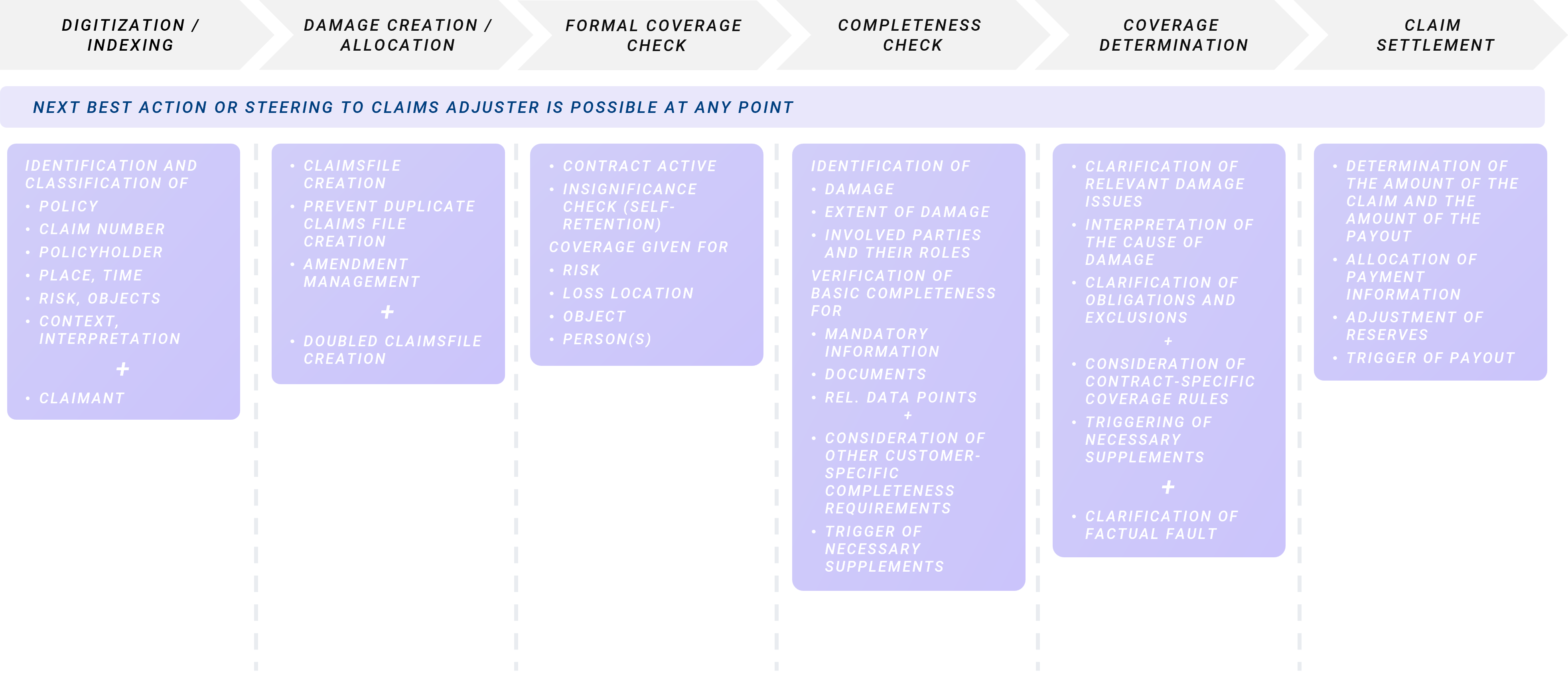

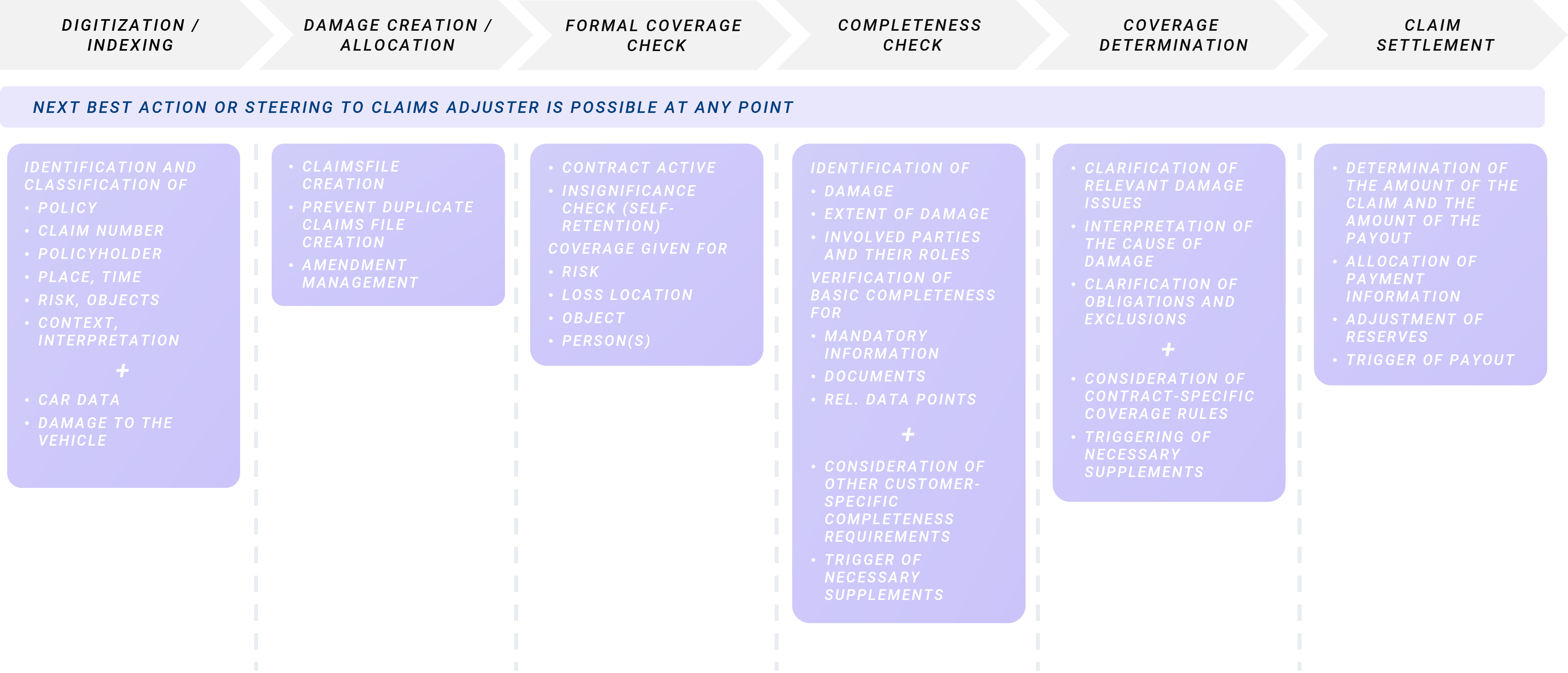

Semi-Automation

Next Best Actions & recommendations

- Focus on medium and very complex claims

- Significant time savings potential (up to 90%) through partial automation

- Example processes: information requests, rejection recommendations, coverage concerns