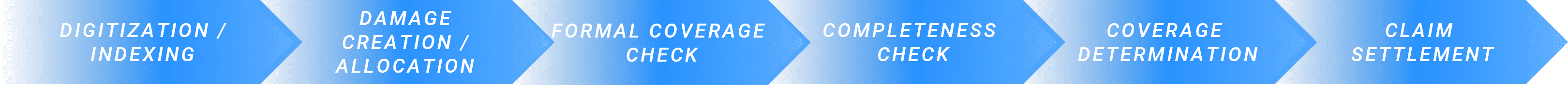

1

Claims indexation

When indexing claims, it is important to identify whether a submitted claim matches an existing claim or whether a new claim should be opened for its matching policy according to identified risk/cause of loss. An integrated duplicate check identifies similar claims within a configured time window of 14 days (default configuration) and prevents duplicated efforts. The workflow action can lead to full automation or recommendations (also called “Next Best Action”). This Next Best Action can essentially have the following characteristics:- Further information must be requested from the claimant as the notification does not contain sufficient information.

- The reported loss details do not match a known policy or existing claim and further explanation is required from the claimant.

- The claim could match multiple policies or multiple open claims and a claims adjuster must make a final selection.

2

Formal Coverage Check

The formal coverage check validates whether the claim in question meets the formal coverage criteria. On the one hand, it is analysed whether the date of the loss event falls within the period in which the policy is in force. Secondly, it is checked whether the damaged object is basically covered by the relevant policy. The workflow action can in turn lead to complete automation or a recommended action (“Next Best Action”) with the following characteristics:- A rejection recommendation will be made due to discrepancies in policy duration or gaps in coverage for the insured risks/perils.

- The damage descriptions and damaged items require further explanation by the person reporting the damage.

3

COMPLETENESS CHECK

To prevent claims decisions being made on the basis of incomplete information and claims handlers manually checking partial information, the omni:us completeness check confirms whether all essential claim details have been identified and are available for the best possible decision. This includes mandatory documents and essential claim information such as loss description, parties involved and other topics that the insurer configures in the omni:us platform. The workflow action can in turn lead to a complete automation or next best action. The following recommended actions are possible during the completeness check:- Request missing mandatory documents;

- Information request for missing mandatory information on the damage and a recommended format/document to obtain missing information (e.g. costs in the form of an invoice)

4

Coverage Determination

At the heart of coverage check is coverage determination, which combines information from insurance products and policies with available claims information. Coverage verification determines whether the damaged objects are confirmed as insured objects according to the coverage and whether a number of coverage questions and criteria could be successfully checked for the given type of loss. If the workflow action has not been fully automated, the following Next Best Action options are available:- Recommendation for rejection because the claim is not covered or reasons for exclusion have been established;

- Mandatory coverage questions could not be answered and the claims adjuster must review selected coverage questions;

- Clarification of damage details such as the circumstances of the loss or further information about damaged items must be requested;

5

Claims Settlement

incl. Payment Recommendation

In order to settle the claim all cost-related information from invoices, appraisals and estimates are structured and sorted according to the respective billers. Costs are grouped by risk exposures and coverage limits and deductibles are applied when calculating final payments for each payee and when making payments to the policyholder. The workflow action can lead to full automation or to the following recommendations (“Next Best Action”):- Mismatch of service provider information with known service provider/partner databases;

- Unknown service provider must be verified before payment;

- Vendor conditions are not yet applied to payments;

- Conflicts with limits and deductibles to be reviewed by the claims administrator;

- The missing bank data must be added;