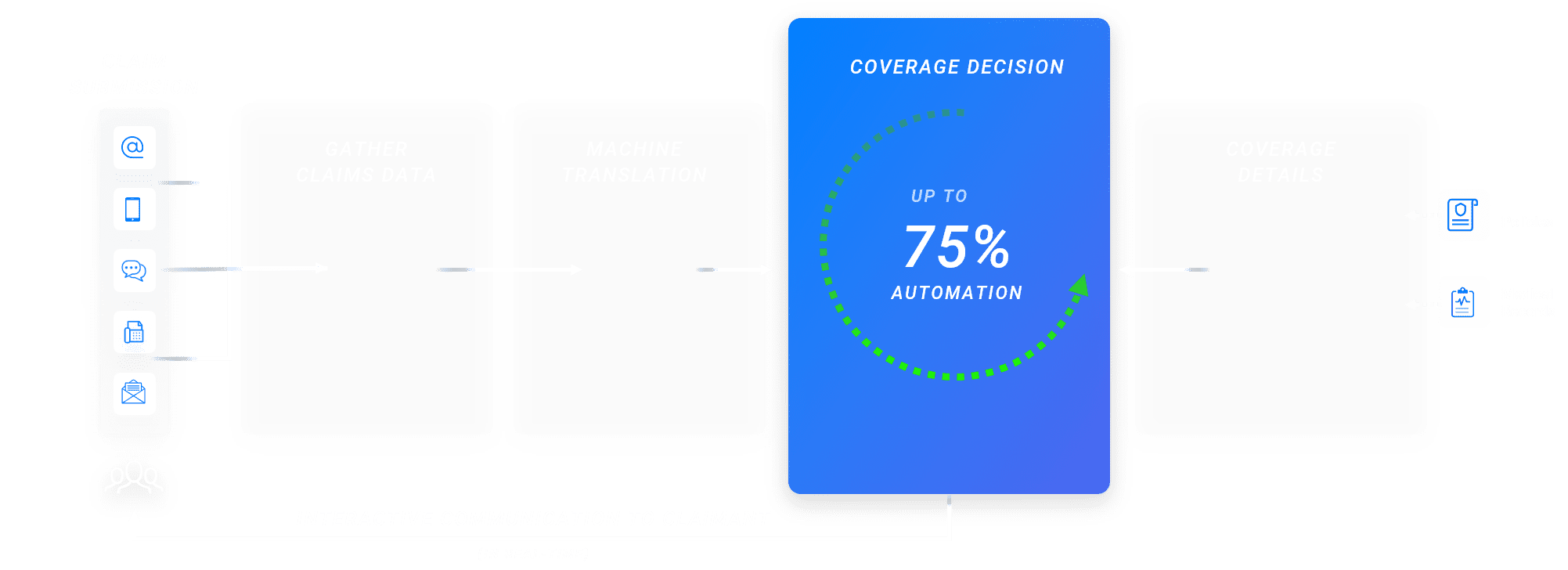

A mid-sized insurer wanted to automate the coverage verification process for high-frequency claims. omni:us empowered the highly manual claims coverage check process to automate the process for low-mid complex high-frequency claims.

omni:us is proud to be one of Europe‘s Horizon2020 SME-Instrument and Fet Flag Champions.

We are grateful to have received funding from the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement No 820323; 850053.

Co-financed by European Fund for Regional Development (EFRE)

Pro Fit-Project “Vollautomatisierung der Wertschöpfungskette im Digitalisierungsprozess von Archivdaten” with support of IBB/EFRE in 2016/2017.