With total car claims paid on the insurance market in Europe rising steadily, and global car ownership rates projected to grow in the coming decades, car insurers are being further incentivized to provide an efficient… Continue Reading

What a year! Sooo many things have happened. It’s hard to believe that 2018 had only 12 months ?. This year’s theme at omni:us was ‘building a foundation’, based on some clarifications. On various levels we forced… Continue Reading

In our recent whitepaper, we explored the new type of insurance customer challenging the industry to modernise - the Gen Y-ers (or Millenials). Here we present a brief summary. Customer-centricity no longer entails what it did a decade ago. With the rise of advanced automation technology comes the rise of new business practices, new disruptors, and most importantly, new types… Continue Reading

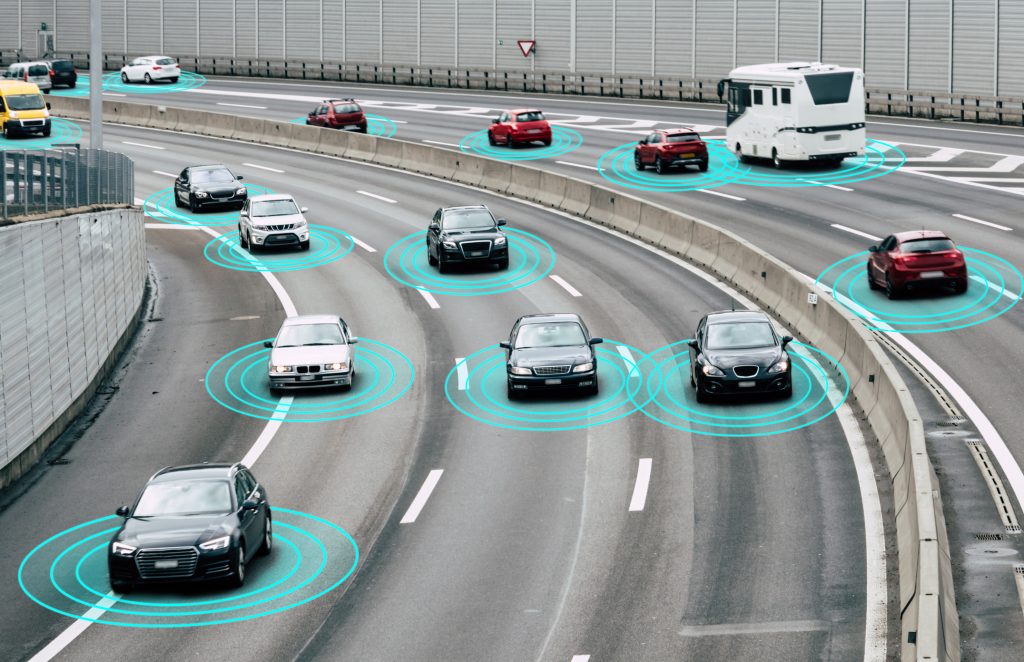

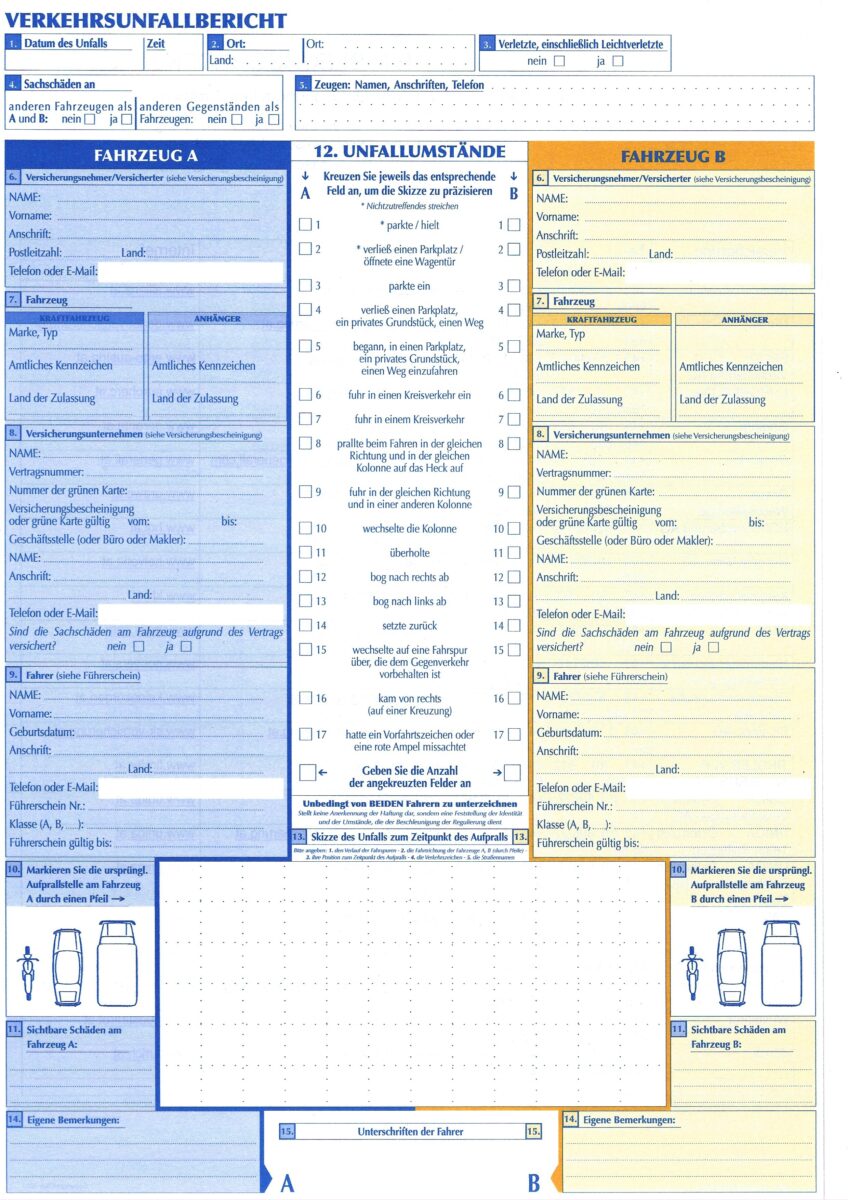

The claims handling process. A crucial operation undertaken daily by insurers. The adjudication of a car claim is a complex process, with insurers gathering a great deal of information, such as claim documents, vehicle registration… Continue Reading

When thinking back to the era of ancient civilisations, it’s unlikely you’d consider insurance and artificial intelligence staples of the time. Rather, they fit much better into the modern day, where technological innovation goes hand-in-hand with better business practices. Yet, the idea of giving artificial beings a form of mind goes back to antiquity, seen in folklore, myths and stories.… Continue Reading

You may think that the insurance industry only gained momentum in the 20th century with the rise of other white-collar jobs, but the idea of mitigating risk dates back to ancient civilisations. Even the Code of Hammurabi, one of the first forms of law in existence, included an early insurance policy in the form of a clause that safeguarded a… Continue Reading

As for many fields, the customer’s experience in business is essential to success. This is especially true for the insurance industry, where policy values and customer retention rates drive profit. Yet the insurance field is littered with unique communication obstacles which can make the path to satisfactory customer experiences a tough one to follow. Sometimes viewed as a grudge purchase,… Continue Reading

The dawn of digital innovation has arrived, and this is evident in the ways that modern business is being conducted. In such a fast-paced time, it’s vital for businesses to be prepared for incoming change and to be aware of the technology available. In a recent report by Accenture, 86% of insurers agreed that to retain a competitive edge, they… Continue Reading

Just a quick recruiting update from my side. The last few months have been hectic but gratifying. The omni:us team has expanded with a steadily growing sales team and some much-needed engineering and scientific reinforcements! So what's been going on? The omni:us engine is gathering momentum and learning, with each iteration of its neural networks, how better to position itself. The specific… Continue Reading

The role of artificial intelligence within the insurance industry is becoming more prevalent than ever. At this year’s omni:us Machine Intelligence Summit, Torsten Oletzky, a Professor at the Insurance Institute of Köln, gave some amazing insights into how the industry has a responsibility to renew itself to remain competitive, and discussed how AI is playing a key role in this reinvention.… Continue Reading